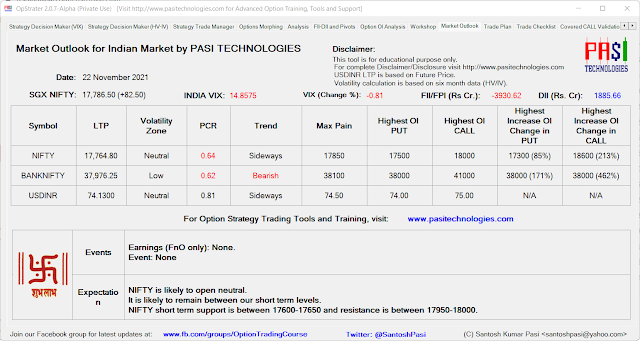

NIFTY is likely to open neutral.

It is likely to remain between our short term levels.

NIFTY short term support is between 17600-17650 and resistance is between 17950-18000.

BANKNIFTY short term support is between 37600-37700 and resistance is between 38470-38570.

Max pain for NIFTY has decreased to 17850.

Max pain for BANKNIFTY has decreased to 38100.

Max pain for USDINR is same at 74.50.

Can look for Long PUT/Short CALL near resistance levels.

Trade setup:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.