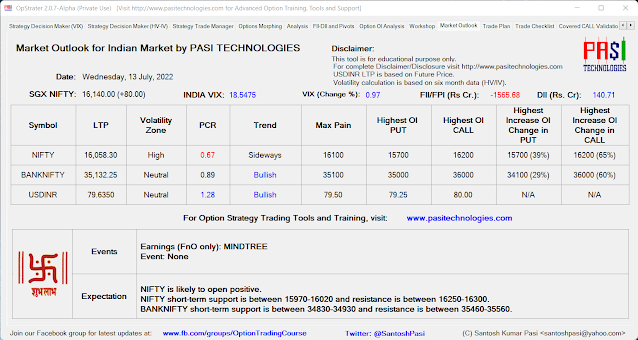

NIFTY is likely to open positive.

NIFTY short-term support is between 15970-16020 and resistance is between 16250-16300.

BANKNIFTY short-term support is between 34830-34930 and resistance is between 35460-35560.

Max pain for NIFTY has decreased to 16100.

Max pain for BANKNIFTY has decreased to 35100.

Max pain for USDINR has increased to 79.50.

Can look for Long PUT/Short CALL on the rally.

At our short-term levels, directional trades can be tried.

Trade setup:

Disclosure:

Portfolio: NIFTYBeeS, LIQUIDBeeS, HCL TECH, HDFC BANK, ICICI BANK, SBI, etc.

Current stock option trades open: None

We regularly trade BANKNIFTY weekly option.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.